top dog health insurance made simple for faster, clearer care

Why speed and clarity matter

Quick approvals and predictable payouts keep stress down and treatment choices open. Efficiency protects both your dog's health and your wallet: fewer surprises, faster claims, better planning.

What to expect from a top-tier policy

Good coverage handles the big stuff without fuss and the small stuff without delays.

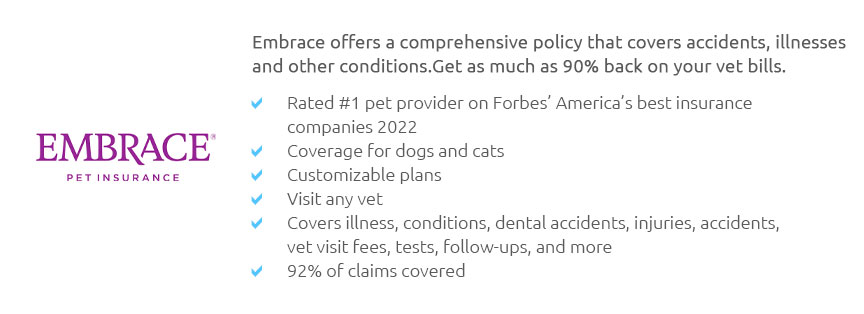

- Accident and illness coverage that includes diagnostics (X-rays, ultrasound, MRI), hospitalization, surgery, and follow-ups.

- Chronic and hereditary conditions covered for life once approved, not just the first year.

- Cancer care with modern treatments like chemo or radiation.

- Prescription meds and medically necessary supplements when prescribed.

- Rehab and alternative therapies (PT, acupuncture) when evidence-based and vet-recommended.

- Emergency and specialty care at any licensed clinic; no restrictive networks is a plus.

- Dental accidents; illness-related dental if specified.

A quick reality check

"Unlimited" coverage sounds absolute; step back - more precisely, it typically means no annual cap but still subject to policy terms and reasonable-and-customary fees. Expectations set now prevent friction later.

Costs, levers, and how to set expectations

Premiums move with choices you control. Tuning these levers balances monthly cost against out-of-pocket risk.

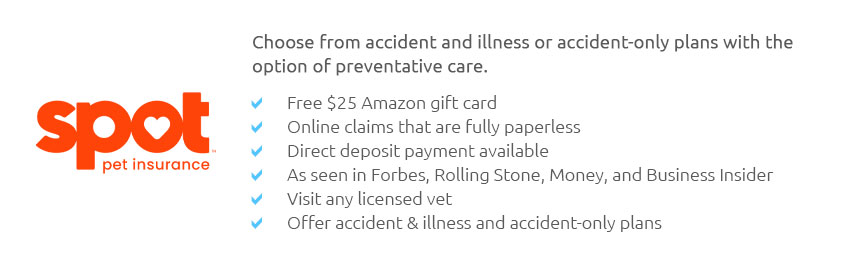

- Annual limit: higher limit reduces risk spikes; true "unlimited" simplifies planning.

- Deductible: higher deductible lowers premium; annual deductibles are easier to track than per-incident.

- Reimbursement %: 70 - 90% is common; 80% strikes a practical balance for many owners.

- Co-pay and exam fees: confirm whether exam fees are covered; they add up.

- Age, breed, and location: large breeds and city ZIP codes trend higher; budgeting early helps.

- Wellness add-ons: convenient, but not always cost-efficient; they're budgeting tools, not insurance.

Claim experience: the real decider

The best policies make claims feel routine, not risky. Fast intake, clear status updates, and transparent math build trust.

Real-world moment: after a late-evening sock-swallow scare, the ER bill hits $1,900. You upload the invoice in under four minutes, the provider pings the clinic for records automatically, and a partial direct payment reduces your card charge at checkout; the remainder reimburses at 80% within 72 hours. Quiet relief. Back to normal.

Efficiency markers

- Direct pay options with ER/specialty clinics to reduce upfront costs.

- Average claim time publicly stated (e.g., 2 - 5 days) and met consistently.

- Pre-authorizations for planned procedures; same-day responses for urgent cases.

- 24/7 vet chat included to triage and possibly avoid ER visits.

- Simple, annual deductibles; no per-condition resets.

- Clear, itemized EOBs so you can forecast future costs quickly.

Coverage details that save headaches later

- Waiting periods: accidents often 2 - 5 days; illnesses 14 - 30; cruciate issues may be longer - note any bilateral clause.

- Pre-existing conditions: most are excluded; some curable issues may be eligible after a symptom-free window.

- Bilateral limitations: if one knee or hip had signs pre-policy, the other may be excluded; read this closely.

- Dental specifics: accidents are standard; illness coverage varies - check limits and cleanings requirements.

- Prescription diets and supplements: sometimes covered only if medically necessary and listed.

- Exam fees and tele-vet: subtle but meaningful differences in reimbursements and access.

Red flags to watch for

- "Schedule of benefits" caps that underpay modern treatments.

- Per-incident deductibles for chronic issues - inefficient over time.

- Broad exclusions for breed-linked conditions without clear definitions.

- Steep price jumps without transparent rationale.

- Claim denials hinging on vague "prior symptom" notes; ask how they interpret records.

Simple decision path

- List your dog's risks (age, breed predispositions, activity level) and your budget ceiling.

- Pick an annual limit that comfortably covers a major surgery plus hospitalization.

- Choose an annual deductible you can pay the same day without stress.

- Set reimbursement at 80% unless you need a lower premium; verify exam fee coverage.

- Compare two policies using one real invoice example to see actual out-of-pocket totals.

Bottom line

Top dog health insurance delivers speed, clarity, and dependable payouts. Define expectations up front, favor policies built for efficient claims, and your future self - facing an urgent decision - will have margin, time, and options.